“Economic Burden of Chronic Illnesses: A Global Perspective – Part 10

Related Articles Economic Burden of Chronic Illnesses: A Global Perspective – Part 10

- Chronic Disease Surveillance And Epidemiology – Part 3: Advanced Methods And Future Directions

- Long-term Effects Of Chronic Illness On Children – Part 3

- Yoga And Mindfulness Practices For Chronic Disease Patients – Part 9

- Dietary Strategies For Coping With Chronic Diseases – Part 7

- Economic Burden Of Chronic Illnesses: A Global Perspective – Part 9

Introduction

With great enthusiasm, let’s explore interesting topics related to Economic Burden of Chronic Illnesses: A Global Perspective – Part 10. Come on knit interesting information and provide new insights to readers.

Table of Content

Absolutely! Here’s a comprehensive article on the economic burden of chronic illnesses, focusing on a global perspective. This is part 10 of a series, so it will build upon previous concepts and delve into specific aspects.

Economic Burden of Chronic Illnesses: A Global Perspective – Part 10: Innovative Financing Mechanisms for Chronic Disease Management

Introduction

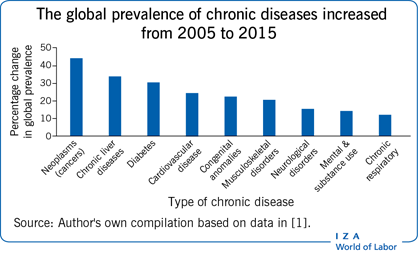

Chronic illnesses, such as cardiovascular diseases, diabetes, cancer, respiratory disorders, and mental health conditions, represent a significant and growing threat to global health and economic stability. The cumulative impact of these conditions extends far beyond individual suffering, placing an immense strain on healthcare systems, economies, and societies worldwide. In previous parts of this series, we have explored the direct and indirect costs associated with chronic diseases, the disparities in access to care, and the implications for productivity and economic growth.

This tenth installment of our series focuses on innovative financing mechanisms for chronic disease management. Traditional healthcare funding models often fall short in addressing the complex and long-term needs of individuals living with chronic conditions. As such, there is a pressing need for innovative approaches that can mobilize resources, incentivize prevention and early detection, and promote efficient and effective chronic disease management strategies.

The Limitations of Traditional Healthcare Financing Models

Traditional healthcare financing models, such as fee-for-service (FFS) systems, often incentivize volume over value. In other words, healthcare providers are reimbursed for each service they provide, regardless of the outcome. This can lead to fragmented care, unnecessary procedures, and a lack of focus on prevention and chronic disease management.

Moreover, traditional models often fail to adequately address the social determinants of health, which play a crucial role in the development and progression of chronic illnesses. Factors such as poverty, lack of access to education, and unhealthy living environments can significantly impact an individual’s risk of developing a chronic condition and their ability to manage it effectively.

The Need for Innovative Financing Mechanisms

To address the limitations of traditional healthcare financing models, there is a growing need for innovative approaches that can:

- Mobilize resources: Attract additional funding from both public and private sources to support chronic disease prevention and management programs.

- Incentivize prevention and early detection: Encourage healthcare providers and individuals to prioritize prevention and early detection efforts, which can reduce the incidence and severity of chronic illnesses.

- Promote efficient and effective care: Foster the delivery of high-quality, coordinated care that is tailored to the individual needs of patients with chronic conditions.

- Address social determinants of health: Integrate social determinants of health into healthcare financing models to address the underlying factors that contribute to chronic disease.

Innovative Financing Mechanisms for Chronic Disease Management

Several innovative financing mechanisms have emerged in recent years to address the challenges of chronic disease management. These mechanisms include:

-

Value-Based Payment (VBP) Models:

- Concept: VBP models reward healthcare providers for delivering high-quality, cost-effective care. These models shift the focus from volume to value, incentivizing providers to improve patient outcomes and reduce costs.

- Examples: Accountable Care Organizations (ACOs), bundled payments, and pay-for-performance programs.

- Benefits: Improved patient outcomes, reduced healthcare costs, and increased provider accountability.

- Challenges: Difficulty in measuring and attributing outcomes, risk adjustment, and data collection.

-

Social Impact Bonds (SIBs):

- Concept: SIBs are a form of impact investing that uses private capital to finance social programs. Investors provide upfront funding for a program, and if the program achieves pre-defined social outcomes, the government or another outcome payer repays the investors with a return.

- Application to Chronic Disease: SIBs can be used to finance programs that address chronic disease prevention and management, such as diabetes prevention programs or smoking cessation initiatives.

- Benefits: Attracts private capital to address social problems, promotes accountability and transparency, and focuses on achieving measurable outcomes.

- Challenges: Complexity in structuring and managing SIBs, difficulty in measuring social impact, and the need for strong partnerships between government, investors, and service providers.

-

Health Impact Bonds (HIBs):

- Concept: HIBs are similar to SIBs but focus specifically on health outcomes. Investors provide upfront funding for health interventions, and if the interventions achieve pre-defined health outcomes, such as reduced hospital readmissions or improved blood sugar control, the outcome payer repays the investors with a return.

- Application to Chronic Disease: HIBs can be used to finance a wide range of chronic disease management programs, such as medication adherence programs, telehealth interventions, and community-based health programs.

- Benefits: Aligns financial incentives with health outcomes, promotes innovation in healthcare delivery, and attracts private capital to address health challenges.

- Challenges: Difficulty in measuring health outcomes, risk adjustment, and the need for robust data systems.

-

Outcomes-Based Contracts (OBCs):

- Concept: OBCs are agreements between healthcare providers and payers that link payment to specific health outcomes. Providers are paid based on their ability to achieve pre-defined outcomes, such as reduced hospital readmissions or improved patient satisfaction.

- Application to Chronic Disease: OBCs can be used to incentivize providers to deliver high-quality care to patients with chronic conditions, such as diabetes, heart failure, or asthma.

- Benefits: Promotes accountability and transparency, aligns financial incentives with health outcomes, and encourages innovation in healthcare delivery.

- Challenges: Difficulty in measuring and attributing outcomes, risk adjustment, and the need for robust data systems.

-

Risk-Sharing Arrangements:

- Concept: Risk-sharing arrangements involve healthcare providers and payers sharing the financial risk associated with healthcare delivery. These arrangements can take various forms, such as shared savings programs, capitation models, and global budgets.

- Application to Chronic Disease: Risk-sharing arrangements can incentivize providers to manage chronic conditions more effectively, reduce unnecessary healthcare utilization, and improve patient outcomes.

- Benefits: Promotes collaboration between providers and payers, aligns financial incentives with health outcomes, and encourages efficient healthcare delivery.

- Challenges: Complexity in structuring and managing risk-sharing arrangements, risk adjustment, and the need for robust data systems.

-

Crowdfunding for Healthcare:

- Concept: Crowdfunding platforms allow individuals to solicit donations from the public to cover healthcare expenses. While not a comprehensive solution, it can provide immediate relief for individuals facing high out-of-pocket costs for chronic disease treatment.

- Benefits: Provides immediate financial assistance, raises awareness about specific health conditions, and fosters community support.

- Challenges: Sustainability, equity concerns (access depends on social networks), and potential for fraud.

-

Tax Incentives for Prevention:

- Concept: Governments can offer tax incentives to individuals and employers who invest in preventive health measures, such as gym memberships, healthy food choices, or smoking cessation programs.

- Benefits: Encourages proactive health management, reduces the long-term burden on healthcare systems, and promotes healthier lifestyles.

- Challenges: Designing effective incentives, monitoring compliance, and ensuring equitable access.

Case Studies of Successful Innovative Financing Mechanisms

Several countries and organizations have successfully implemented innovative financing mechanisms for chronic disease management. For example:

- The United Kingdom’s Social Impact Bond for Diabetes Prevention: This SIB funded a program that provided intensive lifestyle coaching to individuals at high risk of developing type 2 diabetes. The program achieved significant reductions in diabetes incidence, resulting in a return on investment for investors and improved health outcomes for participants.

- The United States’ Accountable Care Organizations (ACOs): ACOs are groups of healthcare providers who work together to deliver coordinated, high-quality care to Medicare beneficiaries. ACOs are incentivized to reduce healthcare costs and improve patient outcomes through shared savings programs.

- The Netherlands’ Bundled Payments for Hip and Knee Replacements: This program pays hospitals a fixed amount for all services related to hip and knee replacements, incentivizing them to reduce costs and improve quality of care.

Conclusion

Innovative financing mechanisms hold immense promise for addressing the economic burden of chronic illnesses. By shifting the focus from volume to value, incentivizing prevention and early detection, and promoting efficient and effective care, these mechanisms can help to improve patient outcomes, reduce healthcare costs, and promote economic stability.

However, the successful implementation of innovative financing mechanisms requires careful planning, robust data systems, and strong partnerships between government, healthcare providers, payers, and investors. It is also essential to address the social determinants of health and ensure that all individuals have access to affordable, high-quality care. As we continue to grapple with the growing burden of chronic illnesses, innovative financing mechanisms will play an increasingly important role in shaping the future of healthcare.

Further Research and Considerations

- Ethical Considerations: As we implement innovative financing mechanisms, it is crucial to ensure that ethical principles are upheld, and that patient autonomy and equity are protected.

- Data Privacy and Security: Robust data systems are essential for measuring outcomes and tracking progress. However, it is crucial to protect patient privacy and ensure the security of sensitive health information.

- Long-Term Sustainability: Innovative financing mechanisms must be designed to be sustainable over the long term. This requires careful consideration of financial incentives, risk sharing, and the need for ongoing evaluation and refinement.

By embracing innovative financing mechanisms and addressing the challenges associated with their implementation, we can create a healthcare system that is better equipped to prevent, manage, and ultimately reduce the economic burden of chronic illnesses.

Leave a Reply