“Financial Challenges of Living with Chronic Illness – Part 9

Related Articles Financial Challenges of Living with Chronic Illness – Part 9

- Telemedicine And Remote Monitoring For Chronic Illness Care – Part 2

- Financial Challenges Of Living With Chronic Illness – Part 5

- Palliative Care And Quality Of Life For Chronic Illness Patients – Part 3

- Holistic Wellness Programs For Chronic Disease Patients – Part 9: Leveraging Community Support And Peer Mentorship For Sustained Health

- Mental Health Interventions For Chronic Disease Patients – Part 8

Introduction

On this special occasion, we are happy to review interesting topics related to Financial Challenges of Living with Chronic Illness – Part 9. Let’s knit interesting information and provide new insights to readers.

Table of Content

Financial Challenges of Living with Chronic Illness – Part 9

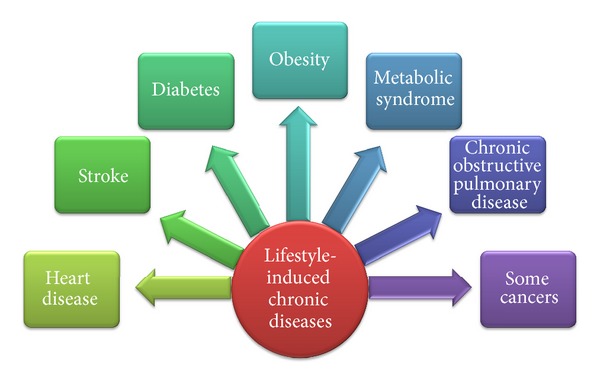

Living with a chronic illness presents numerous challenges, impacting not only physical and emotional well-being but also financial stability. The ongoing medical expenses, coupled with potential limitations in employment, can create a significant financial burden. This article explores the various financial challenges faced by individuals with chronic illnesses and offers potential strategies for managing these difficulties.

The High Cost of Medical Care

One of the most significant financial challenges for individuals with chronic illnesses is the high cost of medical care. This can include:

- Prescription Medications: Many chronic conditions require ongoing medication to manage symptoms and prevent complications. The cost of these medications can be substantial, especially for those who require multiple prescriptions or have limited insurance coverage.

- Doctor Visits: Regular checkups with specialists and primary care physicians are necessary to monitor the condition and adjust treatment plans. These visits can add up quickly, especially if the individual needs to see multiple specialists.

- Diagnostic Tests: Chronic illnesses often require frequent diagnostic tests, such as blood work, imaging scans, and other procedures, to monitor disease progression and treatment effectiveness. These tests can be expensive, particularly if they require specialized equipment or expertise.

- Hospitalizations: Acute exacerbations of chronic conditions may require hospitalization, which can result in significant medical bills. Even with insurance, out-of-pocket costs for hospital stays can be substantial.

- Therapy and Rehabilitation: Many chronic illnesses require ongoing therapy and rehabilitation services to improve function and quality of life. These services can include physical therapy, occupational therapy, speech therapy, and mental health counseling.

- Medical Equipment and Supplies: Individuals with chronic illnesses may need to purchase medical equipment and supplies, such as wheelchairs, walkers, oxygen concentrators, and incontinence products. These items can be expensive and may not be fully covered by insurance.

- Alternative and Complementary Therapies: Some individuals with chronic illnesses turn to alternative and complementary therapies, such as acupuncture, massage, and herbal remedies, to manage their symptoms. These therapies are often not covered by insurance, adding to the financial burden.

Loss of Income

In addition to the high cost of medical care, individuals with chronic illnesses may also experience a loss of income due to their inability to work full-time or at all. This can be due to:

- Reduced Work Hours: Chronic conditions can cause fatigue, pain, and other symptoms that make it difficult to work long hours. As a result, individuals may need to reduce their work hours or take frequent sick days, leading to a decrease in income.

- Inability to Work: Some chronic illnesses can be so debilitating that individuals are unable to work at all. This can be a devastating blow to their financial stability, especially if they are the primary breadwinner for their family.

- Job Discrimination: Individuals with chronic illnesses may face discrimination in the workplace, making it difficult to find or keep a job. Employers may be reluctant to hire or accommodate individuals with chronic conditions due to concerns about absenteeism, productivity, and healthcare costs.

Strategies for Managing Financial Challenges

Despite the significant financial challenges of living with a chronic illness, there are strategies that individuals can use to manage these difficulties:

- Create a Budget: Developing a budget can help individuals track their income and expenses, identify areas where they can cut back, and prioritize essential spending.

- Explore Insurance Options: It is important to explore all available insurance options, including private insurance, government programs like Medicaid and Medicare, and employer-sponsored plans. Compare coverage and costs to find the best option for your needs.

- Seek Financial Assistance: Numerous organizations and programs offer financial assistance to individuals with chronic illnesses. These programs may provide help with medical bills, prescription costs, housing, and other essential expenses.

- Negotiate Medical Bills: Don’t be afraid to negotiate medical bills with healthcare providers and hospitals. Many providers are willing to offer discounts or payment plans to patients who are struggling to afford their care.

- Consider Disability Benefits: If your chronic illness prevents you from working, you may be eligible for Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI). These programs provide monthly cash benefits to individuals who meet certain eligibility requirements.

- Find Affordable Healthcare Options: Explore options for affordable healthcare, such as community health centers, free clinics, and sliding-scale payment programs. These resources can provide access to quality medical care at a reduced cost.

- Manage Prescription Costs: Look for ways to manage prescription costs, such as using generic medications, comparing prices at different pharmacies, and using prescription discount cards.

- Seek Vocational Rehabilitation: Vocational rehabilitation programs can help individuals with chronic illnesses find or return to work. These programs provide job training, counseling, and other support services to help individuals achieve their employment goals.

- Join a Support Group: Connecting with others who have chronic illnesses can provide emotional support and practical advice for managing financial challenges. Support groups can also be a valuable source of information about resources and programs that can help.

- Advocate for Yourself: Be your own advocate when it comes to your healthcare and financial needs. Don’t be afraid to ask questions, challenge denials, and appeal decisions that you believe are unfair.

- Plan for the Future: Create a financial plan that takes into account the potential long-term costs of your chronic illness. This may include saving for retirement, purchasing long-term care insurance, and making arrangements for your care if you become unable to manage on your own.

- Seek Professional Financial Advice: Consider consulting with a financial advisor who has experience working with individuals with chronic illnesses. A financial advisor can help you develop a personalized financial plan that meets your specific needs and goals.

- Explore Remote Work Opportunities: With the rise of remote work, there are more opportunities than ever for individuals with chronic illnesses to work from home. This can provide a flexible and accommodating work environment that allows individuals to manage their symptoms while earning an income.

- Consider Part-Time Employment: If you are unable to work full-time, consider part-time employment. This can provide a source of income while allowing you to manage your health and well-being.

- Utilize Assistive Technology: Assistive technology can help individuals with chronic illnesses perform tasks that they might otherwise be unable to do. This can include devices that help with mobility, communication, and daily living activities.

- Take Advantage of Tax Deductions: Individuals with chronic illnesses may be eligible for certain tax deductions, such as medical expense deductions and disability-related work expenses. Consult with a tax professional to determine which deductions you may be eligible for.

Conclusion

Living with a chronic illness can present significant financial challenges. However, by understanding these challenges and implementing effective strategies, individuals can manage their finances and improve their overall quality of life. It is important to seek support from healthcare providers, financial advisors, and support groups to navigate the complexities of living with a chronic illness and maintain financial stability. Remember that you are not alone, and there are resources available to help you overcome these challenges.

Leave a Reply